Our state-of-the-art API solutions offer comprehensive integration capabilities that streamline your operations, enhance efficiency, and provide real-time access to crucial financial data.

API Banking is a revolutionary approach that allows businesses and developers to integrate banking services directly into their applications or platforms.

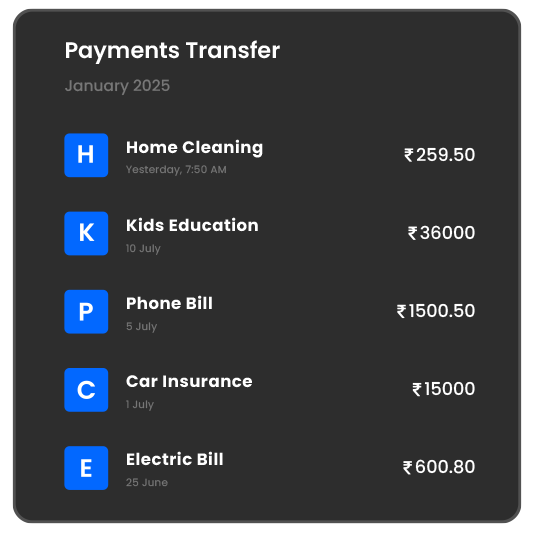

API Banking provides real-time access to financial data, allowing businesses to gain up-to-date insights. This enables better decision-making and financial planning.

By integrating banking services through APIs, businesses can streamline their financial operations, reduce administrative overhead, and enhance overall operational efficiency.

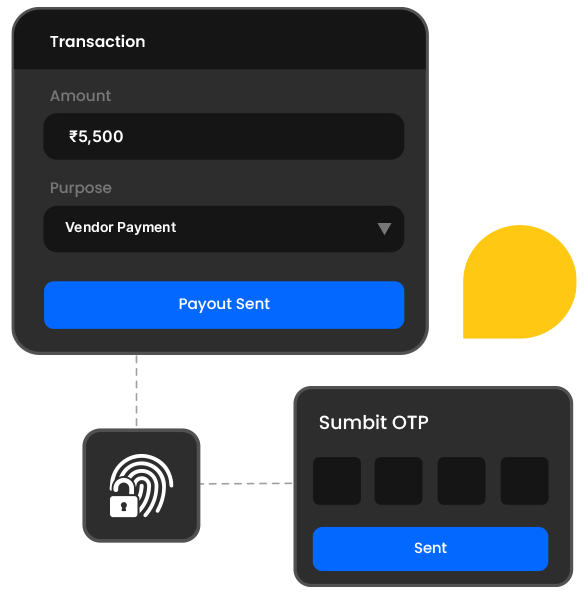

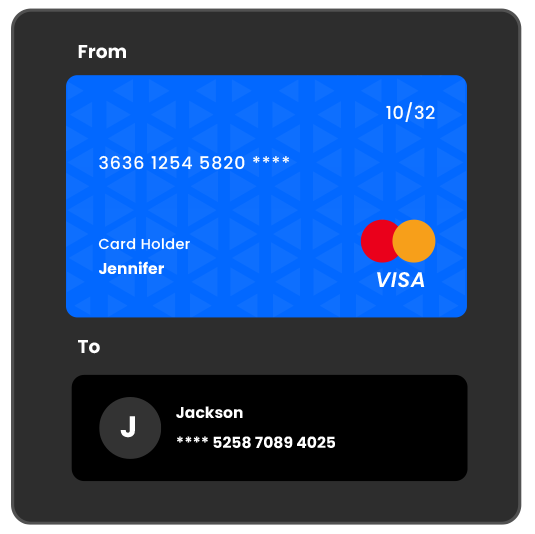

Transactional APIs facilitate real-time processing of payments, fund transfers, and other financial activities, ensuring that transactions are executed swiftly and accurately.

Account Information APIs are essential for businesses and applications that require up-to-date financial information to support decision-making, and reporting.

Payment Initiation APIs facilitate the setup and execution of both single and recurring transactions, offering flexibility and control over payment processes.

Integrate banking solutions effortlessly into your system with scalable, customizable APIs for growth.

Access up-to-the-minute account insights and transaction updates to streamline your business operations.

Protect your financial data with industry-leading security protocols and compliance with national regulations.

Banking is evolving, and with it comes a wave of innovation. Our API banking service opens the door to a new era of banking—one that’s faster, smarter, and more flexible.

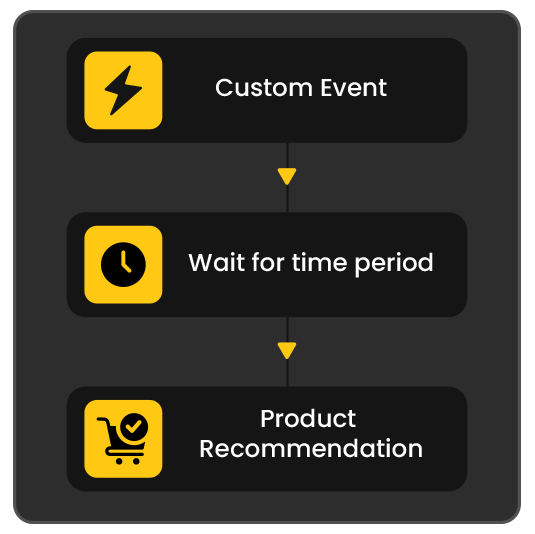

API Banking connects your application or platform directly to banking services. With APIs, you can automate payments, retrieve account information, initiate transfers, and more, all through secure data exchanges with banks.

API Banking streamlines financial operations by enabling automation, improving efficiency, and reducing human errors. It supports real-time transactions, allows bulk payouts, ensures accurate account verification, and provides seamless integration with existing systems.

Yes, our API Banking service adheres to the highest security protocols, including encryption, multi-factor authentication, and regulatory compliance standards to protect your transactions and data.

Absolutely! Our API Banking services are designed to handle large volumes of transactions, allowing you to process bulk payouts effortlessly, automating everything from salary payments to vendor disbursements.