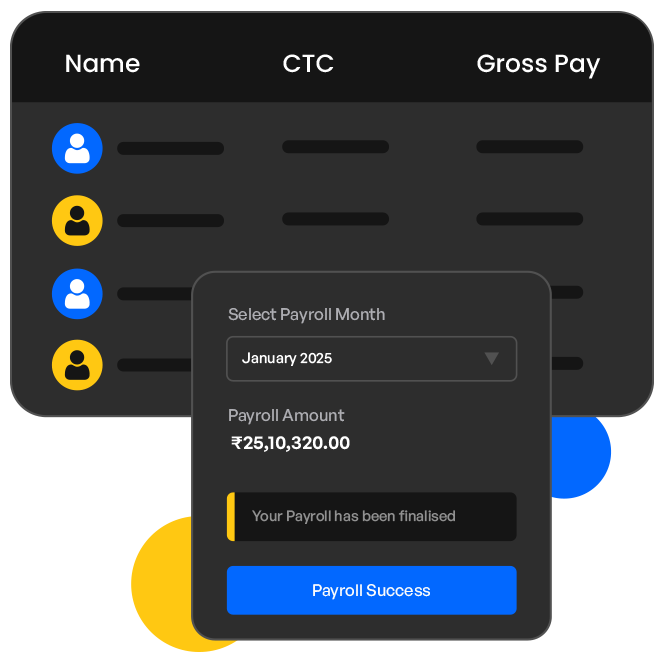

Automatically calculate salaries and deductions, reducing manual errors and saving valuable time.

Easily manage changing tax laws and labor regulations, minimizing risks and ensuring peace of mind.

Allow employees to view pay stubs and tax documents, enhancing transparency and trust.

Launching a startup comes with its own set of challenges, and managing payroll should not be one of them.

Cost-Effective : Affordable payroll services designed specifically for startups, helping you manage expenses without sacrificing quality.

Time Efficiency : Automated payroll processing saves valuable time, allowing you to focus on growing your business.

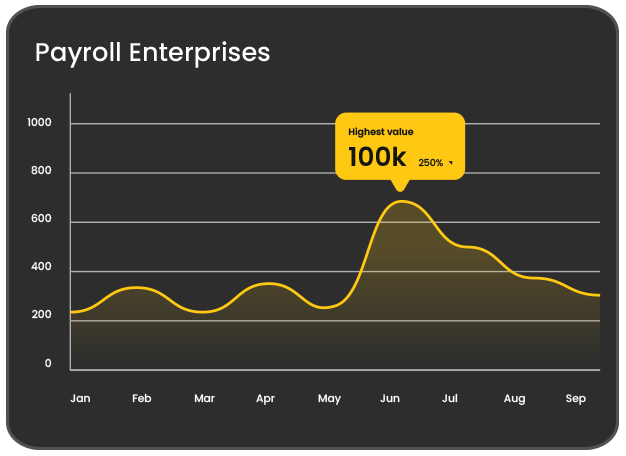

Managing payroll for large enterprises can be a complex and daunting task, but our Payroll for Enterprises service simplifies this process with tailored solutions designed to meet your specific organizational needs.

Our Payroll Service recognizes the diverse needs of businesses, especially as they scale and evolve. That's why we offer extensive customization options tailored specifically to meet your unique organizational requirements.

Tailored Solution : Custom payroll processes align compensation and benefits accurately for every employee.

Enhanced Flexibility : Easily adjust payroll settings to adapt swiftly to changing business needs.

Register for Customizable Payroll Solutions That Adapt to Your Unique Business Needs.

Our solution is designed to streamline and automate every aspect of the payroll process, ensuring accuracy, compliance, and efficiency at every step.

Enable secure, automated salary transfers directly to employees’ bank accounts, reducing processing times and ensuring accuracy.

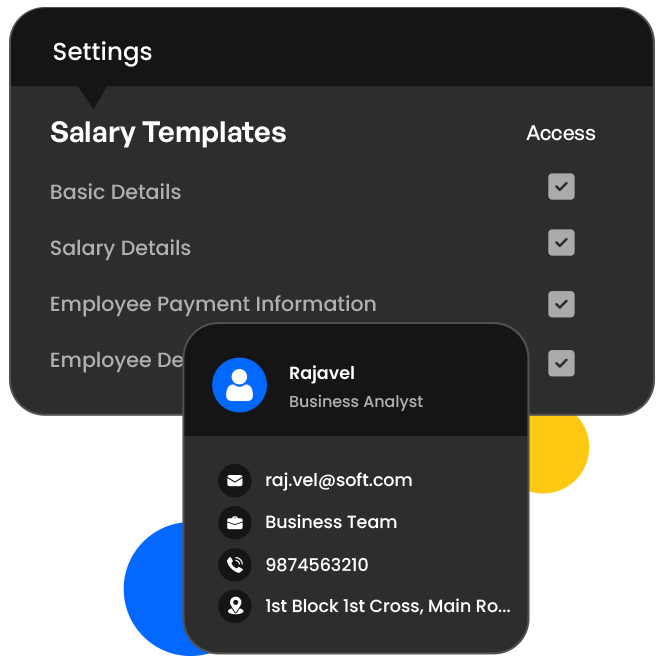

Design payroll structures tailored to your business needs, accommodating various employee roles, pay scales, and benefits.

Simplify tax calculations, deductions, and filings with our integrated system that ensures accuracy and on-time submissions.

Access real-time reports and analytics to track payroll trends, expenses, and optimize your compensation strategy effectively.

Empower employees to access payslips, update details, and manage tax forms through an intuitive self-service dashboard.

Stay compliant with local tax regulations, effortlessly managing deductions, contributions, and filing requirements.

Your questions, expertly answered—streamlining payroll doesn’t have to be complicated.

Our automated payroll processing ensures timely and accurate salary payments by automating calculations, deductions, and disbursements. Simply input your employee data, and our system handles the rest—no manual intervention required.

Absolutely. Our payroll service is fully customizable to accommodate various pay structures, benefits, and bonuses tailored to your business needs. You can configure it to match any unique payroll requirements.

Employees can log in to the self-service portal to view their payslips, update personal information, and manage tax-related forms. It’s a secure and efficient way to reduce administrative overhead.

Yes, our system automatically calculates taxes, deductions, and contributions while ensuring full compliance with local tax regulations. It simplifies the tax process by keeping you up to date with the latest rules.

Yes, you can access real-time payroll insights through our system’s comprehensive reporting tools. These insights help you track payroll expenses and make informed decisions about your compensation strategy.

Yes, our system supports direct bank transfers for secure and automated salary disbursement to employees’ accounts, reducing manual errors and improving efficiency.